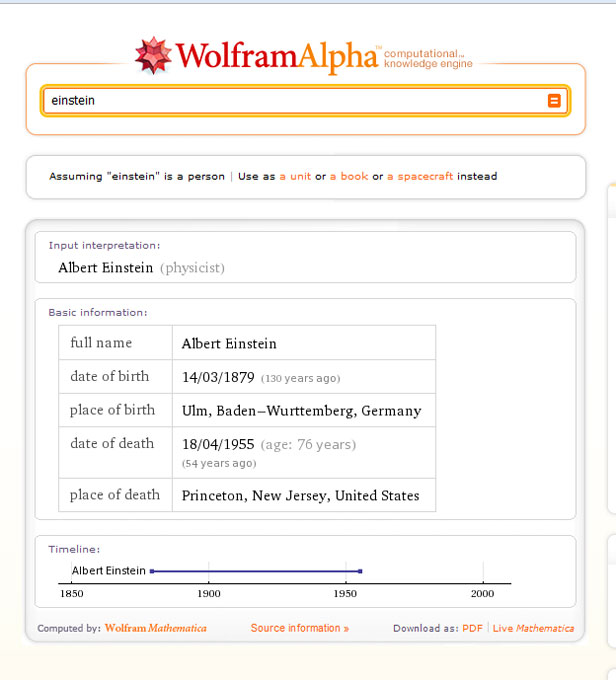

Cirrus Logic didn’t identify the customer, but it was enough to worry investors looking for signs of falling iPhone and iPad sales. (NASDAQ:CRUS) warned of a large inventory write-down because of “a decreased forecast for a high-volume product” from a customer. Apple’s shares fell 5.5% overnight after iPhone supplier Cirrus Logic, Inc. (NASDAQ:AAPL) spread to Asia Thursday, weighing on shares of the U.S. Worries about falling sales at Apple Inc. (NASDAQ:CRUS), which supplies audio chips for the iPhone and iPad, said sales of a particular chip are slowing down as an unnamed customer moves to a newer component.Īpple Jitters Weigh on Asian Suppliers (WSJ) The decline means Apple has -for now- lost its position as the world’s most valuable publicly traded company to Exxon Mobil Corporation (NYSE: XOM), which has a market capitalization a few billion dollars above Apple’s $380 billion price tag. Earlier in the day, it hit $398.11, the lowest level since Dec. The stock was down $21.89, or 5.1 percent, at $404.35 in early afternoon trading. (NASDAQ:AAPL) fell below $400 for the first time in a year and half on Wednesday, after a supplier hinted at a slowdown in iPhone and iPad production. That’s almost certainly a modern record for a company of this size, profitability and growth rate.Īpple Stock Falls to One-Year Low on Supplier News (ABCNews) With $137.1 billion in cash and marketable securities as of December, Apple’s PE ratio ex-cash hit 5.42. On Friday morning, when the stock touched $385.10, Apple’s value hit a new low. (NASDAQ:AAPL) for $7, the stock’s value measured by how much profit it was generating for each outstanding share - the famous PE ratio - hit an all-time low of 5.76, according to Wolfram Alpha (see chart below). In the fall of 2000, when you could buy Apple Inc. As a result, many are now vulnerable after building up inventory in anticipation of continued growth, according to Michael Hasler, a lecturer at the University of Texas in Austin.Īt $385.10, Apple Inc. They relied on Apple to deliver $30.1 billion in orders in the latest reported quarter, according to supply-chain data compiled by Bloomberg. Apple’s breakneck growth to $156.5 billion in revenue last year, from $24.6 billion in 2007 when the iPhone debuted, supports an ecosystem of at least 247 suppliers across the globe. Hon Hai Precision Industry Co., Apple’s top supplier, this month posted its biggest revenue decline in at least 13 years, indicating slower sales of smartphones, tablets and computers.

(NASDAQ: CRUS), a maker of audio chips that gets 91 percent of its sales from Apple, this week reported an inventory glut that suggested slowing iPhone sales, and forecast fiscal first-quarter revenue below analysts’ estimates. (NASDAQ: AAPL)’s slowing sales are rippling through a supplier network that has long benefited from the company’s ability to churn out iPhones and iPads. Wolfram Knowledgebase Curated computable knowledge powering Wolfram|Alpha.Apple slowdown threatens $30 billion global supplier network (WashingtonPost)Īpple Inc.

Wolfram Universal Deployment System Instant deployment across cloud, desktop, mobile, and more. Wolfram Data Framework Semantic framework for real-world data.

0 kommentar(er)

0 kommentar(er)